In cell C8, we will begin writing the formula by pressing = and then writing PMT. Now to calculate the monthly payment, we will input all the data points in the function as below: Supp+ose we have taken a home loan for $2,00000 for 10 years at a 6% interest rate. Let’s take an example to understand how this function works.

#Loan calc excel how to

Now, we will see how to use the PMT function to calculate the monthly payment. How to Use the Formula to get the Amount Monthly Payment? TYPE: “0” or “1” is used to ascertain whether the payment is to be made at the beginning or end of the month.FV: The future value of the investment after all the periodic payments are made.However, some other optional elements can be used for some specific calculations, if needed. For example – for 5 years, we have 60 monthly periods. NPER: the number of periods for loan repayment.If the rate is 4% per annum monthly, it will be 4/12, which is. The PMT function requires 3 elements to calculate the monthly payments: PMT function is used to calculate the monthly payments made towards the repayment of a loan or mortgage.

#Loan calc excel download

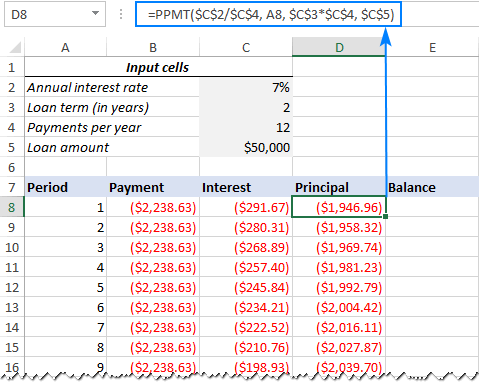

You can download this Excel Mortgage Calculator Template here – Excel Mortgage Calculator Template We can calculate the monthly payments for the loan/mortgage using built-in functions like PMT and other functions like IPMT and PPMT. How to Calculate Monthly Payments for a Loan in Excel? With the help of Excel, you can create a spreadsheet and calculate the monthly payments for yourself. This calculation appears cumbersome to understand for a layman. These elements are used in formulas to calculate the monthly payments for the repayment of your loan.

Excel functions, formula, charts, formatting creating excel dashboard & others

0 kommentar(er)

0 kommentar(er)